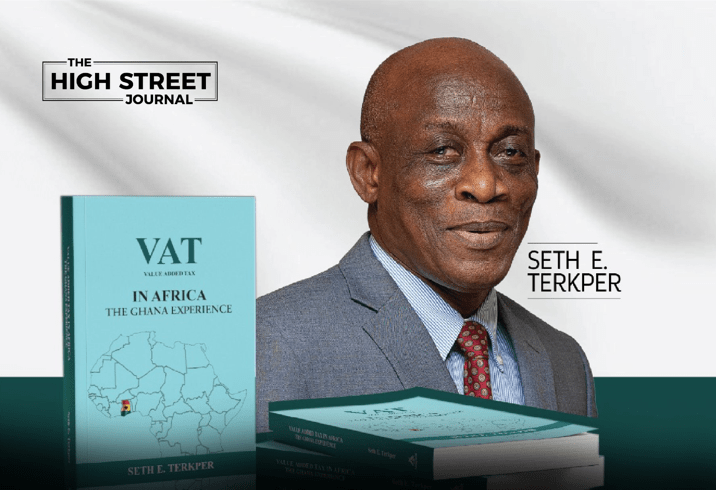

Former Finance Minister and current Economic Advisor to the President, Seth E. Terkper, has launched a new book titled “Value Added Tax (VAT) in Africa: The Ghana Experience”, providing a detailed account of Ghana’s VAT journey and offering policy lessons for the broader African context.

The publication chronicles the evolution of VAT policy in Ghana, from its controversial inception to its successful implementation and consolidation.

Drawing from his personal involvement in Ghana’s tax reforms, including the successful rollout of VAT in 1998 following a failed attempt in 1995.

Terkper presents insights into the administrative, legislative, and political frameworks that shaped the system.

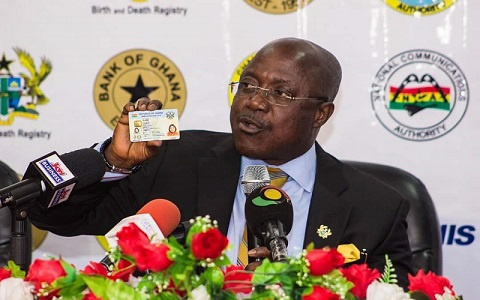

The launch event, held at the Ghana Academy of Arts and Sciences in Accra, brought together a distinguished audience of policymakers, academics, tax experts, and public finance professionals.

The book was formally launched by Alex Segbefia, Chief of Staff at the Office of the Vice-President, with Current Chief of Staff Julius Debrah purchasing the first copy for GH¢30,000.

The event was chaired by Kwame Peprah, Ghana’s Finance Minister from 1995 to 2001, who played a key role in overseeing VAT’s introduction during his tenure.

In his remarks, Mr. Debrah praised Terkper for documenting his expertise in such a critical area of public finance.

“It is not easy for people to compile their knowledge and experiences. For him to do this, I am proud because not many take the time to write,” he said.

He also encouraged the Ghana Revenue Authority (GRA) to work more closely with the private sector to enhance tax education and public awareness.

In his address, Seth Terkper called for a national review of Ghana’s tax strategy, urging policymakers to address inefficiencies and overlaps in the current system.

“We need a more coherent tax structure, one that doesn’t replicate or interfere with the foundational tax types we already have,” he stressed, pointing specifically to Ghana’s four core tax categories: VAT, income tax, customs duties, and petroleum taxes.

Terkper argued that eliminating distortions and overlaps would improve policy clarity, boost compliance, and strengthen revenue mobilisation.

“Value Added Tax (VAT) in Africa: The Ghana Experience” is expected to become a key reference for students, researchers, tax practitioners, and policymakers seeking deeper insights into tax administration and reform across the continent.

Source: Myxyzonline.com