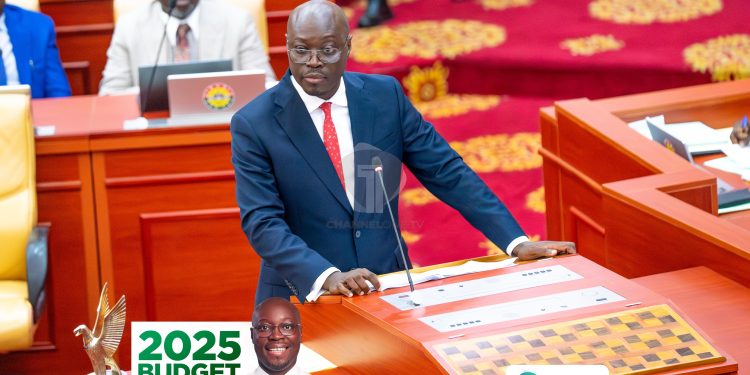

The 2025 national budget was presented today, March 11, 2025, by the Minister for Finance, Hon. Dr. Cassiel Ato Forson. In his address to Parliament, the Minister highlighted the government’s financial situation, focusing on the outstanding debts inherited from the previous administration and the abolishment of certain taxes.

Outstanding Debts and Arrears

As of December 2024, the total arrears and payables of the central government stood at GH¢67.5 billion, which is equivalent to 5.2% of GDP. The road sector alone accounted for GH¢21 billion. A review of the arrears revealed that GH¢67.5 billion is owed to government contractors and suppliers, including GH¢49.2 billion in unpaid Interim Payment Certificates and invoices, and GH¢18.3 billion in unpaid Bank Transfer Advice at the Controller and Accountant-General’s Department.

Additionally, the total arrears do not include the following:

- US$1.73 billion owed to Independent Power Producers (IPPs);

- GH¢68 billion owed by the Electricity Company of Ghana (ECG);

- GH¢32 billion owed by the Ghana Cocoa Board (COCOBOD); and

- GH¢5.75 billion owed by the Road Fund.

The Bank of Ghana is also seeking a GH¢53 billion bailout to address its negative equity position.

Tax Abolishments

In his address, the Finance Minister also announced the abolishment of several taxes introduced by the previous government, which had caused public concern, especially among the youth and the working class. The taxes being removed include:

- The 10% withholding tax on lottery winnings, also known as the “Betting Tax.”

- The 1% Electronic Transfer Levy (E-Levy).

- The Emission Levy on industries and vehicles.

- The VAT on motor vehicle insurance policies.

- The 1.5% withholding tax on small-scale miners’ winnings from unprocessed gold.

Dr. Forson explained that the removal of these taxes would alleviate the financial burden on households, increase disposable incomes, support business growth, and improve overall tax compliance.

Source: J.W. Quarm